‘A sure thing is better than a maybe’

There are 2 reasons First Home Buyers consider buying second-hand homes.

The first is they think they have to. A lot of First Home Buyers imagine they will have to settle for a run-down house in a poor area that needs to be fixed up or even worse they imagine their first step into the property market will have to be an apartment as this is the only thing they can afford.

The second reason is they think they will be better off. Often this is a misconception, thinking they will get a better deal on the block, house, or area by buying second-hand.

This article is going to deep dive into 3 key reasons why that type of thinking is a mistake.

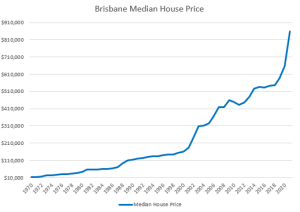

Overwhelmingly the biggest issue for First Home Buyers is saving up a deposit. This problem is exacerbated by the fact that we are in a constantly moving property market. If you look at real estate for the past 50+ years, you will see 3 very clear trends.

1. Property prices go up – Sometimes quickly, sometimes slowly, property prices consistently and relentlessly continue their march upwards.

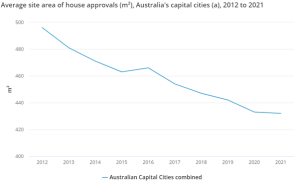

2. Block sizes get smaller – Not only is the price of what you’re buying going up but what you are getting for the money you are paying is going down. From 2008 to 2021 the average block size in Australia has reduced by 29% but during the same period, the median house price has increased by 73%!

https://www.abs.gov.au/articles/new-houses-being-built-smaller-blocks

https://www.abs.gov.au/articles/australians-building-houses-smaller-blocks

3. Affordability moves outwards – In other words where the affordable smaller block is moves further away

According to research conducted by Finder it takes 71% of First Home Buyers between 5 and 10+ years to save up enough deposit to buy a home. As you can see from the data above, property prices are doubling every 7 to 10 years. What this means is by the time you save enough deposit to buy the house you want it will have doubled in value. Now you will have to save even more deposit for the same house, but the house will continue to increase in value.

The math just doesn’t add up.

This leads us to the first of the 3 reasons First home Buyers should avoid existing homes.

Deposit

Let’s say you want to buy an existing built property that is worth $700,000. You will need to save up your deposit (5% minimum) plus your costs.

The following table outlines your typical deposit and cost requirements for an existing home:

| Package | $700,000 |

| Deposit | $35,000 |

| Stamp Duty | $17,350 |

| Lenders Mortgage Insurance | $27,946 |

| Government fees | $3,006 |

| Conveyancing | $1,500 |

| Total deposit and costs | $84,802 |

This is a significant amount of money. This deposit requirement can be dramatically reduced by changing the type of home you purchase. We will discuss this later in the article.

Competition

The second reason First Home Buyers should avoid existing homes is competition. When you buy an existing home, it will either be via auction or negotiation. If you purchase via auction, you will be competing against the open market. Some of the main competitors for you will be downsizers, upsizers, investors, developers, self-managed super funds, and of course, other first-home buyers.

The issue here is almost all of these people have more experience, more money, and more borrowing power than you. It is not unusual for first-home buyers to spend a year or more going from open house to open house looking for their dream home only to be outbid and outfoxed by more experienced players.

The alternative to auctions is to buy via negotiation. You could be negotiating against any of the people mentioned before or you could be negotiating against a figment of the real estate agent’s imagination. The agent works for the vendor and he is incentivised to get every last dollar he can out of buyers.

The real estate market is a jungle for the uninitiated.

Unforeseen Expenses

The third reason First home Buyers should avoid second-hand homes is unforeseen expenses.

Your first couple of years owning your home is going to be a budget adjustment. Most people hustle for the first couple of years to pay down the land and then over time, you earn more, pay less interest and the power of inflation pushes the relative cost of the mortgage down, If you want to see this effect in action ask your parents or grandparents how much they paid for their first house.

The problem with second-hand homes is you don’t know what condition they are in and you have no safety net. Of course, you will get a building inspection but old houses are like old cars. They are perfect for the first 5 to 10 years and then at best they have escalating maintenance costs and at worst can have unexpected catastrophic expenses. For example, the beautiful old tree in the backyard that you loved so much when you bought it grows its roots into all of your pipes and they need to be replaced. The list of potential issues is limitless and because it’s where you and your family live, they must be fixed and paid for immediately.

What is the best alternative to buying existing homes?

If you want to avoid these issues I recommend you consider a house and land package and here are the reasons why:

- Buying a new home will save you years of saving and tens of thousands of dollars in deposit. If you were to buy a $700,000 house and land package, depending on your available support options, you may be able to get into that home for $25,000 or potentially even less. That is significantly less than the $84,802 you would need to buy an established home. What support you are eligible for is dependent on your individual situation.

- The prices are set. You may have to compete with others to get a block of land but you are competing on speed not price. You won’t be outbid, you will just be too slow. It’s far more transparent and easier to navigate.

- Your expenses are predictable and everything is covered under warranty. If you have an issue pick up the phone and the builder will organise to come and fix it. During your first couple of years of a mortgage cash flow predictability is particularly important.

At first glance, buying a second-hand home can sometimes seem an attractive option but when you consider the additional years of saving, the disappointment of missing out at auction and the financial hardship of unforeseen expenses, it becomes quickly apparent that all that glitters is not always gold.

If you would like to know what support options are available for you, how much deposit you need, and where you can afford book in for a free 15 minute First home Foundations call and the team can work it out for you.

Book an appointment with the team here: https://firsthomespecialists.com.au/book-a-call/

Stay Positive. Be Determined.

Let’s build memories in a home you love.