“If I were asked to name the chief benefit of the house, I should say: the house shelters daydreaming, the house protects the dreamer, the house allows one to dream in peace.”

Gaston Bachelard

The decision to buy your first home often sees a war of opposing forces play out in your head.

One side of you dares to dream. A home to call your own, stability and community for your family, barbeques with friends, a space of your own to decorate and to call home.

Another side of you is terrified. It jumps at shadows and assumes the worst. It becomes an expert in macro economics and convinces you that the property bubble is about to burst and you should definitely hold off. It actively searches for doom and gloom to enable you to maintain the status quo even if it’s at the expenses of your dreams.

It’s fear masquerading as logic.

The most common subject of this fear is the mortgage.

Let’s break this down.

You are currently paying $650 per week in rent

A mortgage is going to cost you $850 per week

Seems expensive.

If you are looking to buy your first house, you’re probably saving as well as renting.

$650 rent + 200 per week saving = $850 per week

That’s the same outlay to the $850 per week for the mortgage, but the mortgage is all given to the bank whereas the savings is still yours.

This is a common misconception.

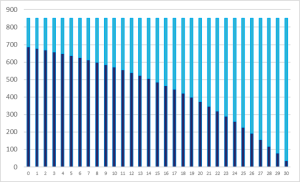

A loan repayment is made up of principal and interest repayments.

Interest is the fee the bank charges you to borrow the money and is determined by your ‘interest rate’. Interest is very similar to rent in that it is dead money.

Principal is you paying off the loan so that money is still yours, however, it is tied up in the property. If you were ever to sell the property, you get all of that money back plus however much the property has gone up in value.

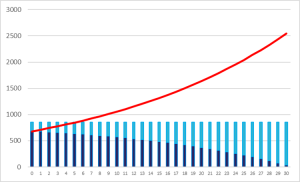

When you first begin a mortgage, the majority of what you pay back is interest, typically around 80% of the repayment, and the remainder is principal. On $850 repayments, $687.50 would be interest (like rent) and $163.50 would be principal (like savings). So, still slightly more expensive than renting ($650) but only just.

This is where things get interesting.

With a mortgage repayment your percentage of interest paid goes down over time as you pay off the loan however the amount you are paying is fixed (subject to interest rate changes) to the initial price of the property.

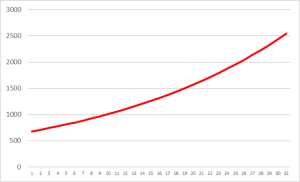

Rent, on the other hand, will go up indefinitely. Historically, rent increases have averaged 4.5% per year but as anyone who is renting now would know, those rental increases can go as high as 25% or more in a year.

Working with these assumptions, if you were to look 20 years down the track, your mortgage repayment would remain the same at $850 (subject to interest rate changes) but your interest (like rent) payment would be $373.95 whereas your principal payment (like savings) would be $477.05. Compare this to a weekly projected rental cost of $1638.16!

A few of you will be reading this and thinking to yourselves “No way is rent going to be that high.” You may even be thinking that the ‘property bubble’ must burst and rents and property prices will come down. No one knows what will happen in the future so I guess there is a chance you could be right but something would need to happen that has never happened in history. If you were betting, it would be long odds.

What you may not realise is people have been saying prices are ridiculous and it can’t continue like this forever. Chat with your grandparents about their first home, ask them what they paid for it. There’s a fair bet it will be something outrageous like $20,000. Ask them what they were worried about at the time. I bet you they tell you they were worried that they overpaid and they wouldn’t be able to make the repayments. Imagine if you could buy that same property at that same price now, you wouldn’t even blink an eyelid.

You are in that moment right now for your grandchildren! In 30 years, they will have wished they could have bought a property at today’s prices and you will be laughing about the things you were stressed about.

It’s all about taking the long–term approach.

Emotionally owning your home makes sense.

Logically owning your home makes sense.

The only thing left is to overcome your fears and live the life you and your family deserve.

If you would like to know what mortgage repayment would be for you book in for a free 15 minute First Home Foundations Call here: https://firsthomespecialists.com.au/book-a-call/

Stay Positive. Be Determined.

Let’s build memories in a home you love.

Leigh.