Why saving a deposit doesn’t work and what you can do about it.

Article 5/6 in our First Home Foundations Series

A wise teacher once brought balloons to school, told her pupils to blow them up, and write their names on one. After the children tossed their balloons into the hall, the teacher moved through the hall mixing them all up. The kids were given five minutes to find the balloon with their name on it, but though they searched frantically, no one found their own balloon.

Then, the teacher told them to take the balloon closest to them and give it to the person whose name was on it. In less than two minutes, everyone was holding their own balloon.

It’s amazing what you can get done with a little bit of help.

This is the principle behind the First Home Foundations — Support.

The traditional route to home ownership was to live on oatmeal, beg, borrow, and steal to save for a deposit – give up a year of your life to real estate inspections only to be outbid and outfoxed by cashed-up and more experienced purchasers.

If it was rough then, it’s impossible now.

Here’s why.

As we’ve discussed previously, the trend in real estate is for prices to go up, block sizes to reduce, and affordability to move outwards.

Our current reality is interest rates have gone up, which means the amount you can borrow has gone down. At the same time, inflation has gone up, meaning the cost of living has gone up pushing your capacity to save down.

For First Home Buyers, this is not good.

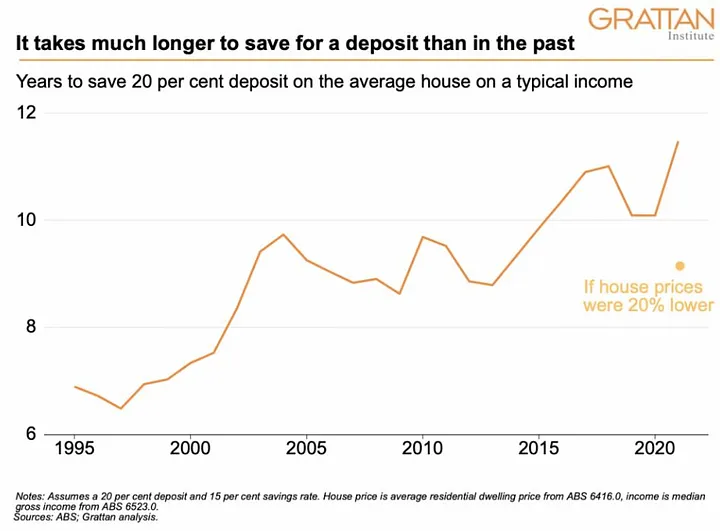

The time to save a deposit has blown out by impossible proportions.

Here are the stats on how long it is taking the average Australian to save a deposit from Finder research.

· 36% of FHB’s take 5 years

· 25% of FHB’s take 5 to 10 years

· 10% of FHB’s take over 10 years

71% of the First Home Buyer market takes over 5 years to save a deposit!

In a property market that keeps rising.

I don’t think I’m exaggerating when I say for most people, this route to homeownership is pretty much impossible.

What should you do?

You need to find someone who has your balloon.

The balloon in this circumstance is support. If you know where to look, there is a lot of support out there for First Home Buyers. Mostly it’s a matter of knowing where to look and what you’re eligible for. In the first instance, this is where I’d suggest you check.

· First Homeowners Grant

· First Home Loan Deposit Scheme

· First Home Super Saver Scheme

· Guarantor

· Family Home Guarantee

· Help to Buy (if it comes to fruition)

Beyond this, there are a few lenders who are prepared to help First Home Buyers with a low deposit.

Quite often, when I talk to clients about buying a home with less than 20% deposit, they or their parents will say they don’t want to pay Lenders’ Mortgage Insurance (LMI). LMI is an insurance that banks take out against loans that have less than a 20% deposit. They charge the premium to their clients and it’s not unusual for the fee to be as much as $20k to $25k.

I’m not a fan of LMI either. The fee is exorbitant, and it protects the bank, not you.

In some cases, we can avoid it completely. In the event we are unable to avoid the fee, it’s not great but it’s not the end of the world.

Logically, you will likely make the premium back in one or two years of your property going up in value.

More to the point, the stability and sense of community that will come from being part of a neighbourhood where you and your family can build long-lasting friendships are priceless.

Building memories in a home you and your family love is the aim of the game but for the vast majority of people, the traditional route to homeownership is dead.

Property prices move faster than you could possibly hope to save.

The only hope is to find someone with your balloon.

If you can, not only is owning a home right now possible; it’s simple, it’s easy, and most of all, it’s fun!